making tax digital

Balancing obligation and opportunity: embracing Making Tax Digital.

What is Making Tax Digital for Income Tax?

Making Tax Digital (MTD) is a government initiative designed to modernise the UK tax system. It mandates digital record-keeping and the use of compliantsoftware to make regular electronic submissions to HM Revenue & Customs.

Under MTD, affected individuals will need to:

Maintain digital records. This means keeping all relevant income and expense data in an electronic format using approved software. Paper records will no longer meet compliance requirements.

Submit quarterly updates of certain income and expenditure to HMRC using MTD-compatible software. Every three months, you’ll send a summary of your business income and expenses to HMRC.

File a year-end tax return to HMRC via MTD-compatible software. At the end of the tax year, you must finalise your figures and submit a full digital tax return to HMRC — replacing the Self Assessment process.

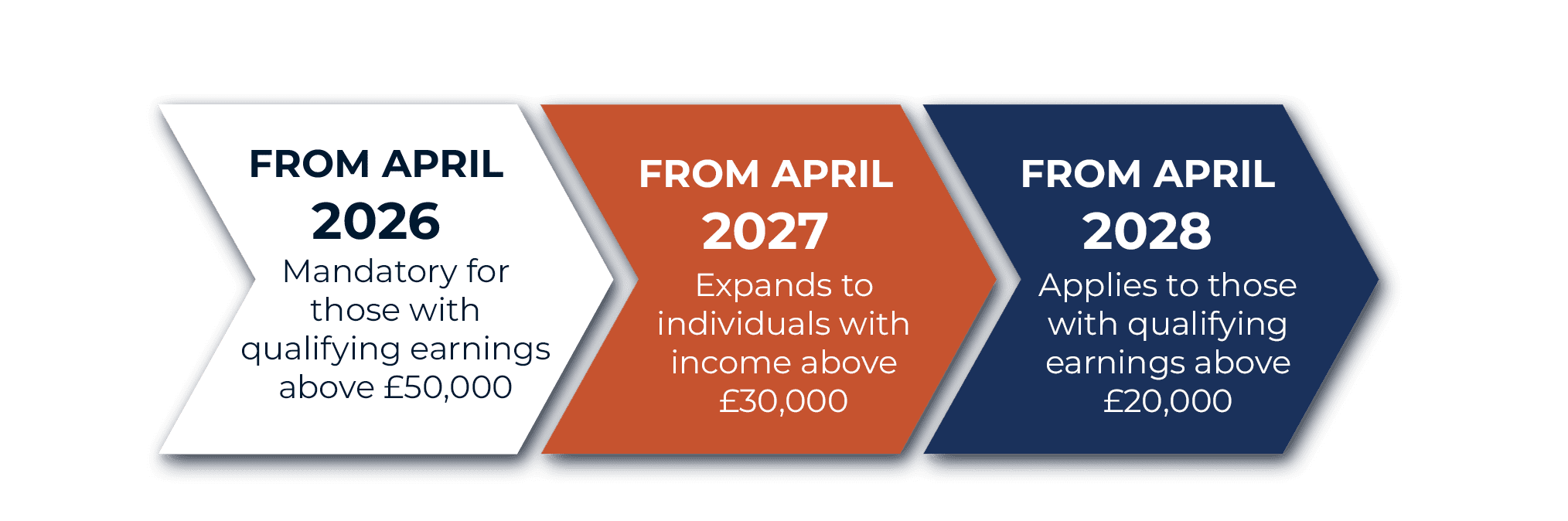

When’s it Happening?

MTD for Income Tax is being introduced in phases, becoming a legal requirement for individuals when their combined gross property and/or self-employment income exceeds the following thresholds at certain dates.

Some exemptions are available but these are unlikely to apply to the majority of taxpayers.

What do you need to do now?

To comply with MTD, you must transition to using compatible software to maintain digital records and be able to submit information to HMRC electronically.

Download out MTD brochure for further information about the upcoming changes and clear, practical guidance on how best to prepare.

Have questions or need tailored advice?

Get in touch – our team is ready to help you take the next steps with confidence!

Making Tax Digital for Landlords

Landlords with annual property income above £10,000 will need to follow the rules for MTD for Income Tax from 6 April 2023.

Making Tax Digital for Self-Assessment

Here’s our overview of the upcoming changes to self-assessment, namely MTD which will apply from 6 April 2023.

MTD and Digital Links

An overview of the Digital Links aspect of MTD, and the benefits of moving to a cloud accounting system.

Your next move…

Digital Tax compliance done right.