Blogs

Stay in the know

Group VAT registration

These can be quite useful, particularly if there are lots of sales between group members as it removes the need for VAT to be charged. If a taxpayer is deregistered under its...

National minimum wage from 1 October 2016

In case you missed it the rates went up again from 1 October 2016! For workers aged 21 and over it has risen to £6.95 per hour, persons aged between 18 and 20 now must receive...

VAT on craft fairs

Where a stall holder gains the right to participate as a seller in a high quality, well organised craft fair of which only one element is the pitch then the supply is taxable...

VAT recovery on cars

If you are a taxi driver, car hire business or driving school, or buying a car for resale you can claim back the VAT (if VAT registered and making taxable supplies). But what...

Estates and the nil rate dividend band and gross interest

Two changes, effective from 6 April 2016 will result in more estates having to settle tax liabilities arising during the period of administration. Prior to 6 April 2016 most...

Secondary annuities market

Plans that would have enabled individuals to sell their annuities for a lump sum have been abandoned due to concerns that there would be too few purchasers in the market to...

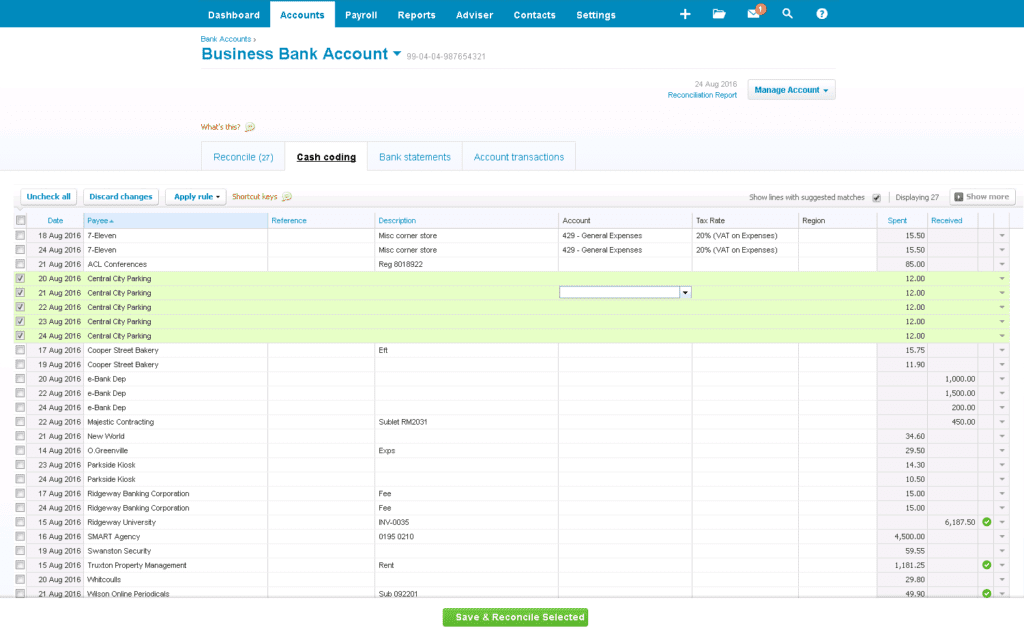

Cash Coding on Xero

Do you have lots of transactions that all relate to the same thing? Use cash coding to reconcile multiple transactions rather than creating a payment for each one...

Invest with HMRC?!

Following the reduction in base rate in August from 0.5% to 0.25%, HMRC have amended the interest rate due on late paid tax. HMRC have reduced all interest charge rates from...

Lifetime allowance (pensions)

Pension scheme members can now apply to protect their pension savings from the lifetime allowance tax charge using HMRC’s website. The online service replaces the interim...